Impacts of Trump Tax Cuts on Seniors’ Finances

Trump tax cuts, or the TCJA of 2017, are ending in 2025, affecting retirees’ finances through reverted tax rates, altered deductions, and estate tax changes; initial impact on seniors was mild due to unchanged Social Security and investment income tax, but they now must adapt for 2026 as previous tax norms return.

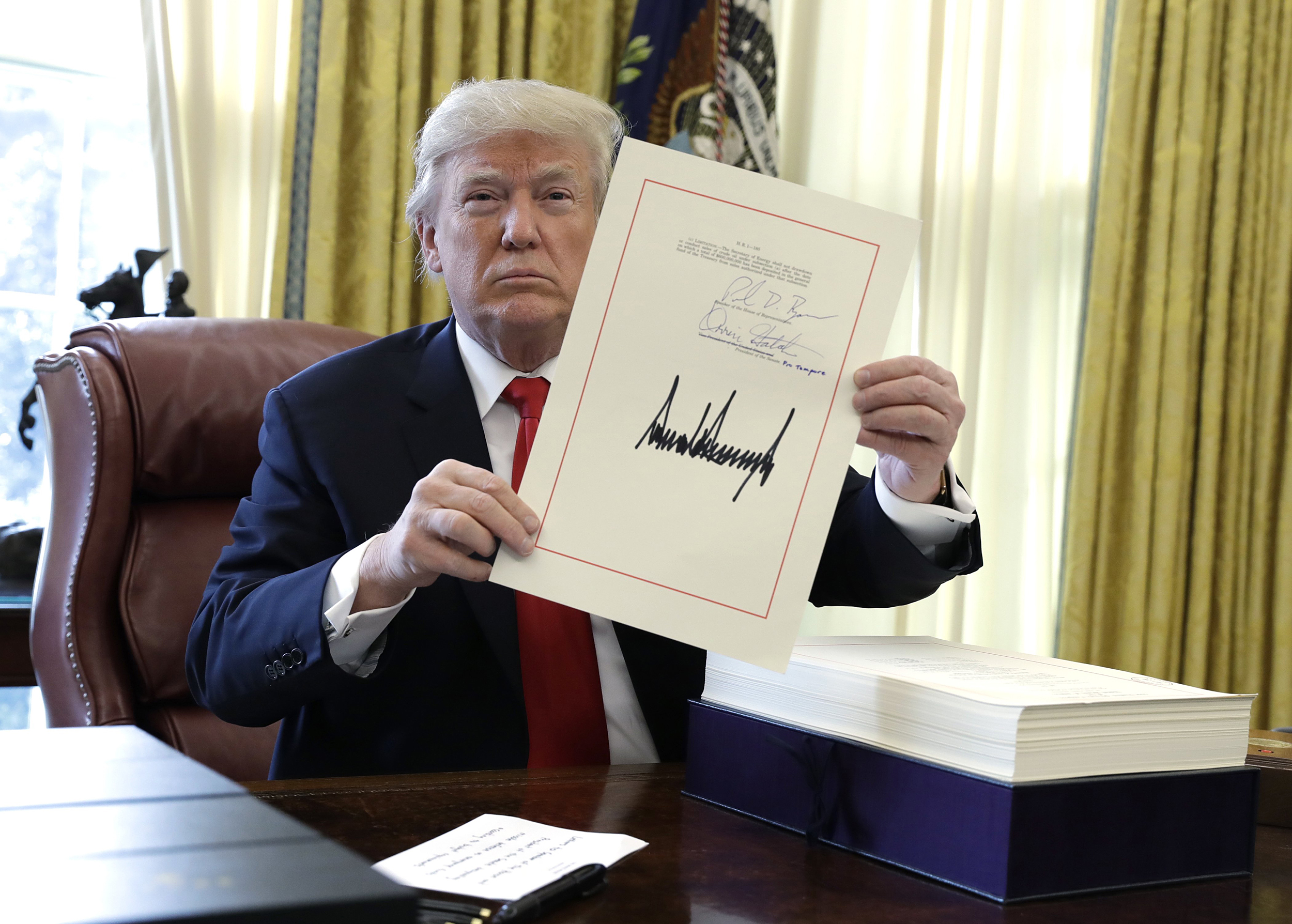

The Tax Cuts and Jobs Act (TCJA), known as the Trump tax cuts, became law on December 22, 2017 and will expire on 2025. (PHOTO: NBC News)

READ ALSO: CRYPTOCURRENCY TRADING FOR DUMMIES: UNVEILING THE SECRETS TO SUCCESSFUL INVESTMENTS

Trump Tax Cut Effects Near 2025 Expiry: Retirees to Navigate Financial Changes

The Tax Cuts and Jobs Act (TCJA), known as the Trump tax cuts, became law on December 22, 2017. According to Go Banking Rates, it brought changes to tax rates, but these changes are set to expire in 2025 unless Congress acts. This will affect retirees’ finances as tax rates revert to how they were before the TCJA.

Initially, retirees were less affected as the Trump Tax Cut didn’t change how Social Security and investment income are taxed. However, starting from January 1, 2026, seniors will need to adjust their spending and taxes as standard deductions, estate tax rules, and charitable contribution deductions go back to pre-TCJA levels.

READ ALSO: HUNTER BIDEN INVESTIGATION: GOP COMMITTEE CHAIRS ISSUE SUBPOENAS FOR TESTIMONY

Trump Tax Cut Simplified Retiree Taxes, Raised Standard Deductions: 2023 Figures and Future Estate Tax Uncertainty Revealed

The Trump Tax Cut made taxes simpler for many retirees by increasing the standard deduction and reducing the need for complicated itemized deductions, as reported.

For the tax year 2023 (filed in April 2024), the standard deduction amounts are:

- $13,850 for singles,

- $27,700 for married couples filing jointly, and

- $20,800 for heads of households.

- Seniors who are 65 or older, or blind, can add an extra $1,850 to these amounts.

The changes also affected estate tax deductions, which increased substantially, benefiting families transferring property to heirs. For seniors, the exemption rose to $12.92 million in 2023. However, beyond 2025, the estate tax rules might change depending on the results of the 2024 presidential election. Charitable contributions were also impacted, as the Trump Tax Cut led more people to use the standard deduction, affecting organizations that depend on donations.

READ ALSO: INDIA’S MOON LANDING AMBITIONS SOAR: CHANDRAYAAN-3 PROBE CAPTURES STUNNING LUNAR IMAGES