Risks of Bitcoins Profile Increases Relative to Stocks, Silver Faces Economic Pressure: McGlone’s Analysis

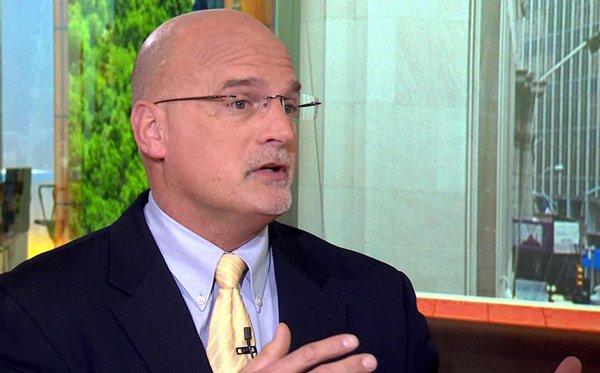

Commodity strategist Mike McGlone sheds light on the risks of bitcoins in the cryptocurrency and precious metals markets, emphasizing bitcoin’s low volatility, susceptibility to market trends, and potential lag in returns compared to tech stocks, while also addressing the challenges affecting silver’s performance.

Commodity strategist Mike McGlone reveals the shifting risks of bitcoins in cryptocurrency and precious metals markets, highlighting their low volatility and vulnerability to market trends. (PHOTO: newsofFinance)

READ ALSO: DISCOVER THE TOP 6 WORST US AIRPORTS FOR DELAYS: PLAN YOUR SUMMER TRAVEL WISELY!

Commodity Strategist Mike McGlone Sheds Light on Evolving Risks of Bitcoins Landscape in Cryptocurrency and Precious Metals Markets

Prominent commodity strategist Mike McGlone has recently drawn attention to shifts in the risks of bitcoins landscape of both the cryptocurrency and precious metals markets. In a client communication dated August 2, 2023, the Bloomberg Intelligence analyst highlighted bitcoin’s unusual combination of low volatility and potential vulnerability to broader market trends. While its 180-day volatility remains at record lows of approximately 46%, McGlone cautioned that deviations from the Nasdaq 100 index, especially in relation to the ongoing second-half market swings and tightening by the Federal Reserve, could signal heightened frailty in risks of bitcoins assets. According to Bitcoin.com, he suggests that the cryptocurrency’s deviation from traditional market patterns might impact its relative performance against tech stocks, particularly if the equity market experiences increased volatility.

The report stated that McGlone’s analysis also delves into the evolving nature of risks of bitcoins as an asset. While he envisions a gradual shift toward attributes akin to gold or Treasuries as mainstream acceptance grows, he predicts that risks of bitcoins lagging returns compared to tech stocks could persist in the short term. This is especially true if the equity market succumbs to seasonal volatility, intensified by ongoing interest rate hikes by the Federal Reserve and receding fears of an impending recession, as reported.

READ ALSO: THE ULTIMATE GUIDE ON HOW TO BUILD A CRYPTO TRADING BOT AND UNLEASH THE FUTURE

Navigating Precious Metals Challenges: McGlone Examines Silver’s Path Amidst Gold’s Potential Surge and Risks of Bitcoins

Shifting focus to the precious metals market, McGlone sheds light on the challenges facing silver. He suggests that, despite gold’s potential for a recession-driven surge that could surpass its current resistance level of $30, silver may find it difficult to follow suit, as the report further stated. With gold demonstrating stability around $2,000 per ounce and silver oscillating between $23 and $25, McGlone points to economic indicators from China and the significant inversion in the U.S. yield curve as factors that could cause silver to regress to an average of around $20. He emphasizes the historically strong correlation between gold and silver prices since 1949, implying that a divergence is unusual and likely to be temporary, as reported.

McGlone’s earlier projections in March had indicated the potential for a bitcoin supercycle, surpassing gold’s performance by a considerable margin. However, his most recent update on August 6 underscores a significant shift in perspective. He now asserts that risks of bitcoins carry a higher risk relative to stocks compared to early 2021 when it was closely aligned with the Dow Jones Industrial Average. With cryptocurrency volatility now triple that of the blue-chip index and correlations reaching historical peaks, McGlone highlights the reduced diversification incentive for risks of bitcoins unless it can demonstrate improved portfolio returns. Additionally, he warns that a potential recession-driven stock market retreat, not yet factored into consensus forecasts, could further pressure risks of bitcoins performance.

READ ALSO: ST PAUL SHOOTING INCIDENT: COMMUNITY GATHERS FOR CANDLELIGHT VIGIL HONORING 12-YEAR-OLD MARKEE JONES

Pingback: Things You Can Buy With Bitcoin, Here’s What You Need To Know! – Building Crypto