A Crypto Literacy Scale was developed by a university researcher from the University of Connecticut to more accurately assess investors’ knowledge levels.

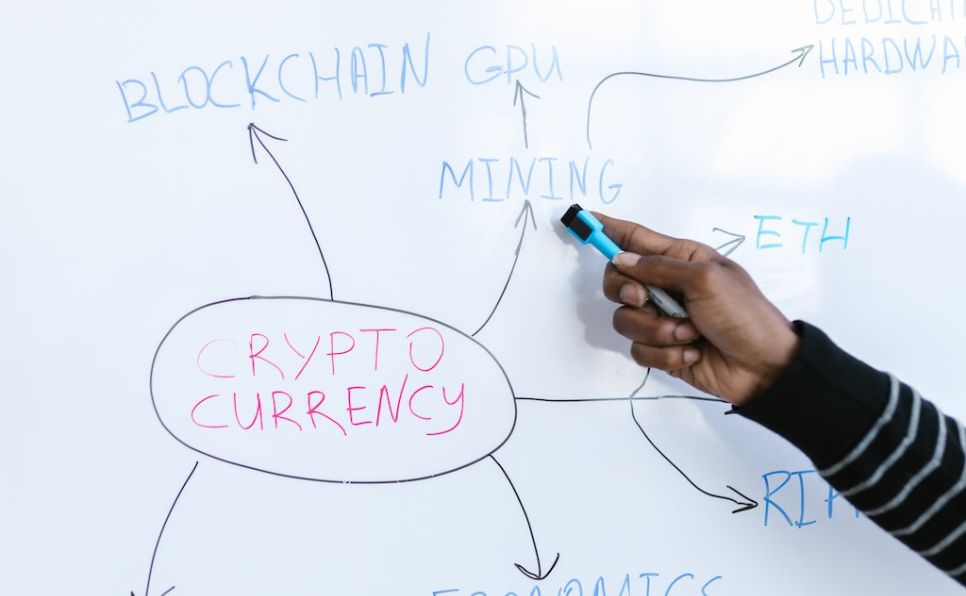

A University Researcher sets out to develop and evaluate a scale that assesses a person’s familiarity with what they refer to as crypto-economics (Photo: RockitCoin)

“Measuring Crypto Literacy,” according to university researcher

In a recent research paper titled by the university researcher “Measuring Crypto Literacy,” researchers from the University of Connecticut set out to develop and evaluate a scale that assesses a person’s familiarity with what they refer to as cryptoeconomics.

According to co-author Michael Jones, an economics professor at the University of Cincinnati, “We want to create a rigorous tool that gives a university researcher, policymakers, and the industry a baseline of crypto literacy.”

300 students who have engaged with crypto were polled on campus, according to Jones, who spoke with Decrypt. The findings revealed that 10-15% of respondents have lost cryptocurrency, maybe as a result of fraud or poor private key management by a university researcher.

According to a university researcher poor figures “are unacceptable if crypto is to go mainstream”

According to him, those figures “are unacceptable if crypto is to go mainstream,” emphasizing the demand for the crypto literacy scale. A university researcher concentrated on three main areas while creating what they called the Crypto Literacy Scale (CLS): technology, economics, and policy.

There are ten questions in the comprehensive crypto literacy assessment. These include: Who verifies the legitimacy of a Bitcoin transfer? What does a hardware wallet’s “seed phrase” mean? Which of the following claims regarding Bitcoin and Ethereum is accurate? Then, people are given a score between 0 and 10 and assigned to the respective category. Low cryptoliteracy is defined as a score of 0–4, medium cryptoliteracy as a score of 5-7, and high cryptoliteracy as a score of 8–10.

He revealed to Decrypt that they also came up with a “Quick 5” list of inquiries. The purpose of this subset is to enable other university researcher and institutions to integrate them into different financial realms and, ideally, build upon what Jones refers to as “The start.”