As student loan payments resume across the nation, millions of Americans, like Dr. Annelise Eriksen, a San Francisco-based dentist, grapple with the impending financial burden.

Student Loan Payments Resume, Placing Financial Burden on Graduates

READ ALSO:Nebraska Volleyball Schedule Draws Unprecedented Crowd, Setting A New Benchmark For Big Ten

Eriksen, who graduated from dental school in 2019, revealed she owes a staggering $480,000 exclusively from dental school loans that she has to pay now that student loan payments resume. For many like her, the pressure intensifies as they have had a three-year relief from these payments due to the pandemic and now student loan payments resume. This relief, however, has come to an abrupt end as student loan payments resume. On September 1, with student loan payments resume, interest began accruing for a whopping 43 million Americans. Eriksen’s plight underscores the broader issue: “In order to keep up with the interest rates, I’d have to start making payments of $3,000 a month,” she lamented. These figures are solely from the interest her loans generate every month. The enormous amounts of debt many professionals carry has sparked discussions on the sustainability and fairness of the current system, particularly as student loan payments resume nationwide. “I didn’t take out any student loans for my undergrad. That’s all dental school loans. My largest loan amounts to $70,000 with a 7.5% interest rate,” Dr. Eriksen added, highlighting the expensive cost of pursuing specialized education in the U.S.

Recent Graduates Brace for Impact as Student Loan Payments Resume

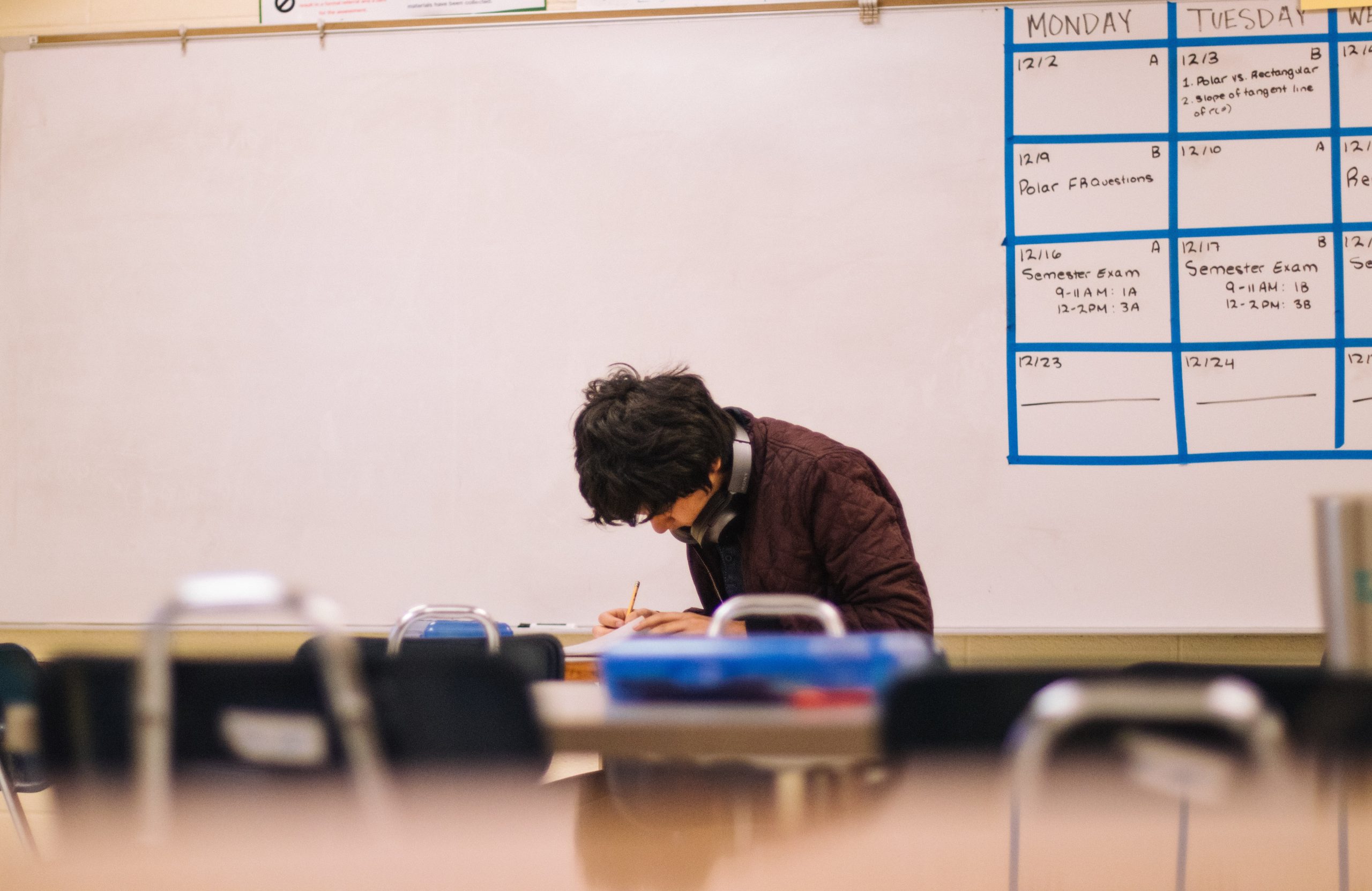

As Student Loan Payments Resume, Concerns Mount Over National Debt Crisis (PHOTO: Jeswin)

Betsy Mayotte, president of the Institute of Student Loan Advisors, offers some guidance for those feeling overwhelmed as student loan payments resume. Her top three tips now that student loan payments resume are: know where your loans are, understand your exact payment amount, and explore options for lower payment plans. With proper management and awareness, borrowers can navigate this challenging financial landscape. To further assist borrowers, there are a few relief measures in place. One notable provision is the one-year grace period for federal student loan borrowers. This means that, as student loan payments resume, those who miss payments won’t immediately go into default or have their missteps reported to credit agencies.