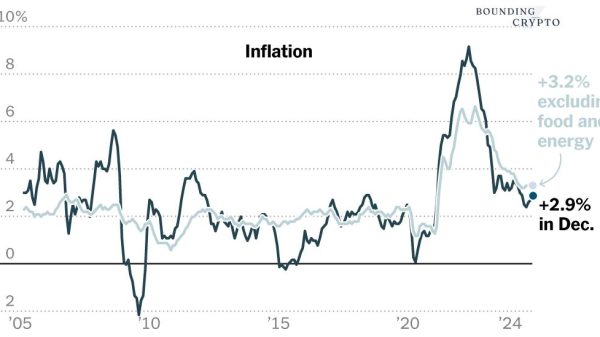

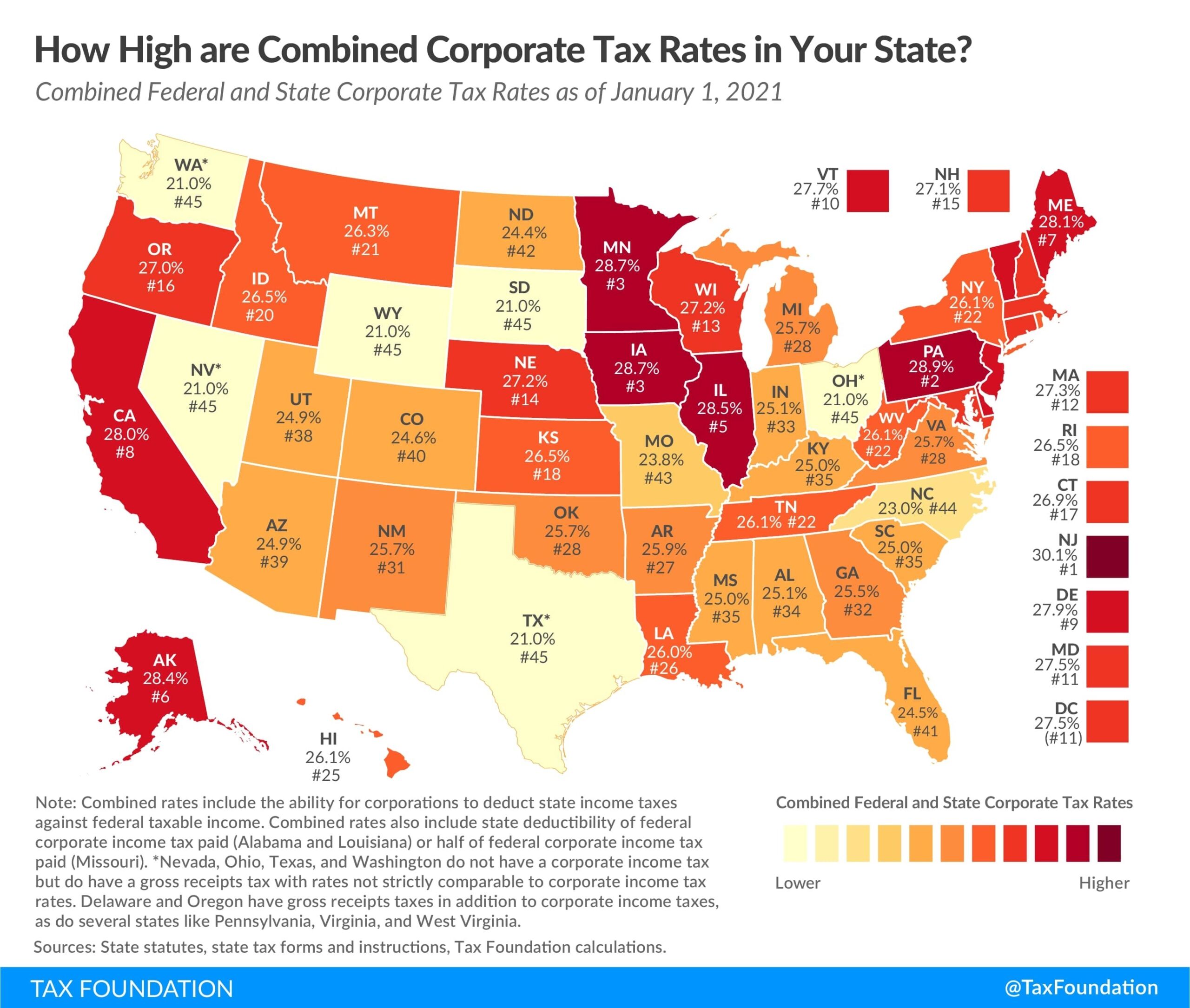

As of Jan 1, Minnesota’s corporate tax remains at 9.8%, stated as the highest corporate tax in the U.S. followed by Illinois (9.50%).

When we think about the corporate sector, large buildings with hefty revenue are the first picture that comes into our mind, but most of the corporations in Minnesota are small businesses. More than 65 percent of corporations have less than 20 employees while 80 percent hold less than 100 employees in Minnesota.

Photo by Tax Foundation

With the start of 2024, Minnesotans have faced the hit by the National Federation of Independent Business with a reminder that Minnesota has the highest corporate tax rate in the United States.

Previously the tag of having the highest corporate tax rate was held by New Jersey. Now, New Jersey’s corporate rate has dropped to 9 percent, which happened after the expiration of a 2.5 percent surtax on corporate income over $1,000,000 at the end of 2023.

NFIB Minnesota State Director, John Reynolds has stated, “While some might think the ‘high tax’ label as applying only to very blue states in the Northeast or on the West Coast, Minnesota has one of the worst overall tax burdens in the country.” He further stated that Minnesota ranks in the bottom ten in major tax rates.

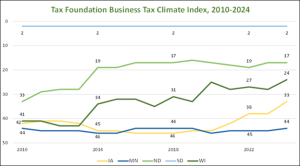

With passing years Minnesota’s tax and business environment has only become increasingly non-competitive with its neighbor countries. As per records of the Tax Foundation’s 2024 Business Tax Climate rankings, Minnesota has remained one of the least friendly states for business taxes.

While Minnesota held the bottom position over the past decade, its neighboring countries have made notable advancements to their business tax environments which are primarily based on factors that impact individuals and consumers.

Only four years ago this record was held by Iowa, being the state with the highest corporate tax rate with a 12 percent rate. Looking at the situation, Hawkeye State has commenced sweeping tax reform that aims to ultimately reduce its corporate rates to a flat 5.5 percent and individual rates to a flat 3.9 percent in 2026. It is predicted that their Business Tax Climate ranking is going to improve in the coming years.

The Tax Foundation reports state that Minnesota has featured as the 12th highest average state and local tax burden state in the country, which is by far the worst among its neighbors. The average Minnesotan used to pay $7,763 in state and local taxes per year in 2022. If we compare the rate with its neighbors:

- Wisconsinite paid $6,231: which is $1,532 short by MN.

- Iowan paid $6,086: which is $1,677 short by MN.

- North Dakota paid $5,403: which is short by $2,360 by MN.

These are findings reported through a recent WalletHub survey, which also found that Minnesota has the 8th highest joint property, income, and sales tax burden in the United States.

NFIB has called the state lawmakers regarding the creation of a tax system that will eventually reduce the burden on small business owners.

Reynolds stated that Minnesota lawmakers need to give Main Street a break. He further added, “If legislators won’t reduce Minnesota’s exorbitant top tax rates, they can at least create a fair system that makes it easier for small businesses to grow, compete, and thrive in Minnesota.”