Marylanders burdened with student loans have a glimmer of hope as the state introduces its Maryland Student Loan Tax Credit program.

Apply Now for the Maryland Student Loan Tax Credit Initiative

This initiative is aimed at assisting those striving to meet their educational financial obligations. With a staggering $18 million in tax credits available, the Maryland Student Loan Tax Credit could prove to be a pivotal turning point for many in the state. The Maryland Student Loan Tax Credit, launched earlier this summer, has garnered significant attention among student loan borrowers. Opening on July 1, the application process for the credit will conclude on September 15, emphasizing the urgency for eligible candidates to make the most of this opportunity. As the deadline looms, the Maryland Student Loan Tax Credit program is expected to see a surge in applications. To be eligible for the Maryland Student Loan Tax Credit, there are specific criteria applicants must fulfill. Borrowers should have incurred a minimum of $20,000 in undergraduate or graduate debt, and hold at least $5,000 in outstanding debt at the time of application. Additionally, claiming Maryland residency for the 2023 tax year and filing the 2023 state income taxes are prerequisites to qualify for the Maryland Student Loan Tax Credit.

Maryland Pioneers Debt Relief with the Maryland Student Loan Tax Credit Program

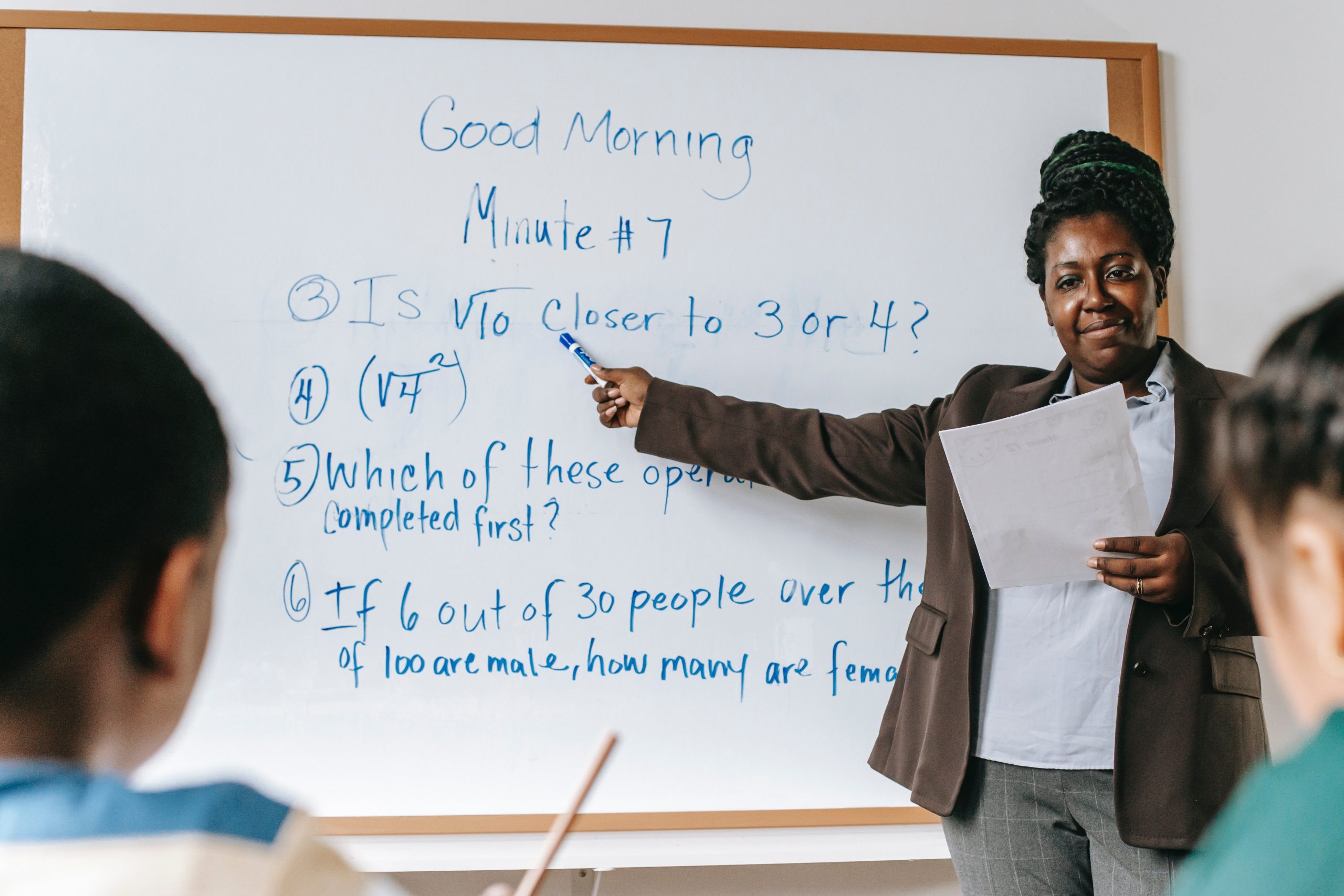

Maryland Student Loan Tax Credit Program: A Beacon of Hope for Debt-Laden Students (PHOTO: Katerina)

The application process for the Maryland Student Loan Tax Credit, accessible via the Maryland Higher Education Commission’s website, is straightforward yet crucial. An estimated completion time of 10 to 30 minutes might seem brief, but applicants are urged to ensure accuracy. The Maryland Student Loan Tax Credit’s overarching message is clear: errors or omissions can be costly, potentially resulting in application rejection or prolonged review times. A unique aspect of the Maryland Student Loan Tax Credit is the stipulation on the utilization of the credit. Recipients are mandated to direct the credit towards their college debt. To maintain transparency and ensure compliance, they are required to submit evidence of this use to the Maryland Higher Education Commission within a three-year timeframe. Failure to do so could initiate the “recapture” process, demanding the credit’s return to the state, further underscoring the importance of adhering to the Maryland Student Loan Tax Credit guidelines.

READ ALSO: Taylor Swift Sends Shockwaves Through Silicon Valley Economy With $33M Boost