Tax season can be stressful, especially when you’re eagerly waiting for your IRS state tax refund. Luckily, the IRS and state tax authorities provide online tools to help you track your refund. This guide will walk you through the process of checking your refund status, what to expect, and what to do if there are delays.

IRS State Tax Refund

| Topic | Details |

|---|---|

| Federal Refund Tracking | Use the IRS “Where’s My Refund?” tool on IRS.gov |

| State Refund Tracking | Check your state’s Department of Revenue website |

| Processing Time | IRS: 21 days for e-filed returns, States: Varies (2-12 weeks) |

| Required Information | SSN/ITIN, Filing Status, and Exact Refund Amount |

| Common Delays | Incorrect info, errors, identity verification, or paper filing |

Checking your IRS and state tax refund status is simple using the IRS “Where’s My Refund?” tool and state-specific refund trackers. Understanding common delays can help set expectations and avoid unnecessary stress. If your refund takes longer than expected, use the official tools provided by the IRS and your state tax authority before calling for assistance.

Also Check: $3500, $1600, and $1100 CPP Payments For these Canadians in 2025 – How to get it? Check Payment Criteria

How to Track Your Federal IRS State Tax Refund

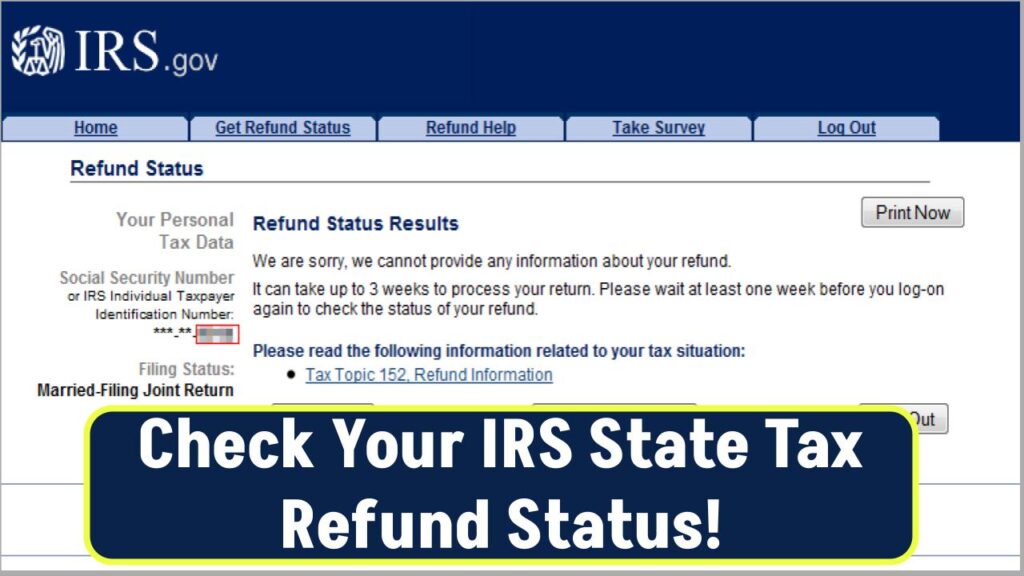

The IRS provides the “Where’s My Refund?” tool to track the status of your refund. Follow these steps:

1. Visit the IRS Refund Tracking Tool

- Go to https://www.irs.gov/refunds.

- Click on “Check My Refund Status.”

2. Enter Required Information

To check your refund, you’ll need:

- Social Security Number (SSN) or ITIN

- Filing status (Single, Married, Head of Household, etc.)

- Exact refund amount (found on your tax return)

3. Understanding Your Refund Status

Once entered, the tool will display one of three statuses:

- Return Received – The IRS has received your return and is processing it.

- Refund Approved – Your refund has been processed and is being prepared for payment.

- Refund Sent – Your refund has been deposited or mailed.

Tip: The IRS updates refund statuses daily, usually overnight.

4. How Long Does It Take to Get Your Federal Tax Refund?

- E-filed with Direct Deposit: 21 days

- Paper Return: 6-8 weeks

- Mailed Check: Additional mailing time applies

If your refund is delayed beyond these times, you may need to contact the IRS at 1-800-829-1040.

How to Track Your IRS State Tax Refund

Each state has its own refund tracking system. Here’s how you can check your state tax refund status:

1. Find Your State’s Tax Authority

Visit your state’s Department of Revenue website. Some examples:

- California: Franchise Tax Board Refund Status

- New York: Income Tax Refund Status

- Georgia: Check My Refund Status

2. Enter Your Refund Details

Most states require the following:

- SSN or Taxpayer ID

- Filing Status

- Exact Refund Amount

3. Typical Processing Time for State Refunds

- E-filed Returns: 2-6 weeks

- Paper Returns: 6-12 weeks

If your refund is delayed, check for notices from your state’s tax authority or contact their customer service.

Common Reasons for IRS State Tax Refund Delays

1. Errors or Missing Information

Any discrepancies in your tax return may cause delays. Double-check for typos in SSN, income, or deductions.

2. Identity Verification

If the IRS suspects fraud, you may need to verify your identity at IRS Identity Verification.

3. Additional Review

Returns with large refunds, credits (EITC, Child Tax Credit), or amended returns may take longer for approval.

4. Paper Filings Take Longer

If you mailed your return instead of e-filing, expect a delay of several weeks.

Pro Tip: Opt for direct deposit to get your refund faster.

Also Check: $3455 Social Security Monthly Payments Boost In 2025 – Trump’s Senior Fairness Act, Payment Date

IRS State Tax Refund (FAQs)

How often does the IRS update refund statuses?

The IRS updates refund statuses once per day, usually overnight.

What if my refund is taking longer than expected?

Wait at least 21 days (e-file) or 6 weeks (paper file) before contacting the IRS.

Use the IRS “Where’s My Refund?” tool to check for updates.

Can I call the IRS about my refund?

Yes, but only if more than 21 days (e-file) or 6 weeks (paper file) have passed.

IRS Phone: 1-800-829-1040

What if my state refund is delayed?

Visit your state’s tax department website and use their refund tracking tool.

Processing times vary, but most refunds arrive within 2-12 weeks.

Will my refund be delayed if I claimed tax credits?

Yes. If you claimed the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC), refunds may be delayed until mid-February.