The latest report from the U.S. government has some important news about price changes. In December, consumer prices rose by 0.4 percent. This increase is notable because it is the biggest jump in monthly prices since February. It raises questions about how well the Federal Reserve’s efforts to control inflation are working. Many people are likely wondering what this means for their own budgets and spending.

What’s Happening with Prices?

As we dive into the numbers, it’s clear that many of the price increases come from necessities. Grocery prices surged, especially eggs, which have been affected by supply issues. This rise, along with other essentials, led to an overall increase in consumer prices.

- The Consumer Price Index (CPI) rose 0.4 percent in December.

- Compared to December 2022, the CPI increased 2.9 percent.

- This is the fastest one-month increase since February of the previous year.

Core Inflation Insights

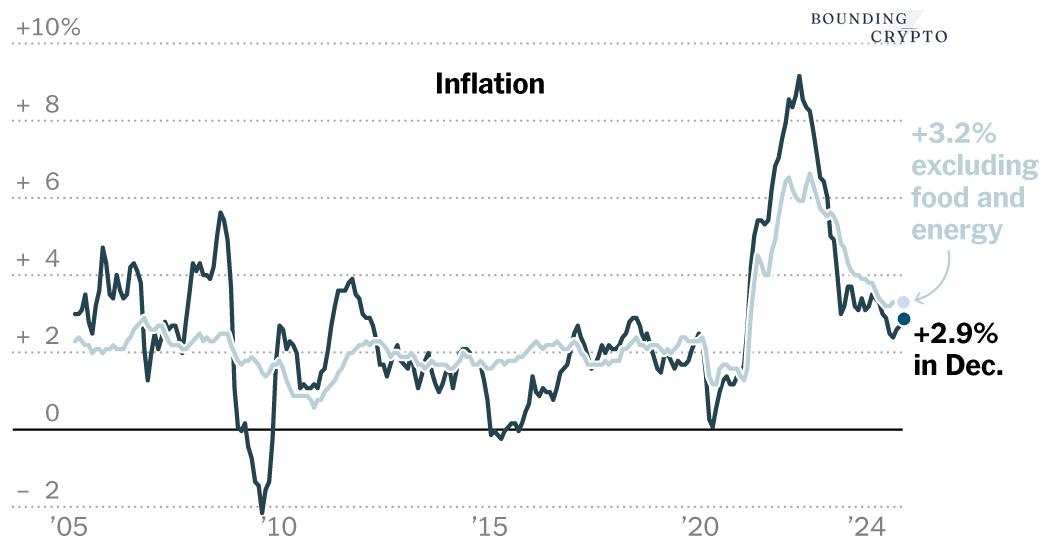

One interesting part of this report is the core inflation rate, which excludes food and energy costs because they can be very volatile. This core inflation figure increased by 3.2 percent over the last year, but it actually showed a surprising slow down compared to previous months.

- Core inflation had been higher, but these latest numbers are a bit of relief for consumers.

- Despite some prices staying high, many items have stabilized.

Why Does This Matter?

You might be wondering why these numbers are so important. Well, they can affect decisions made by the Federal Reserve, the group that manages the U.S. economy. If inflation continues to rise, the Fed might decide to raise interest rates again. Higher interest rates can lead to more expensive loans and mortgages, which could affect families’ budgets.

- Inflation peaked at over 9 percent in mid-2022, so the shift is worth noting.

- Many experts are watching closely to see what the Fed will do next.

Looking Ahead

As analysts weigh in on the implications of the December trends, consumers are left with mixed feelings. On the one hand, the cooling of prices in certain areas is welcomed news. On the other, persistent price increases in groceries and other essentials keep everyone on alert.

| Month | CPI Increase (%) | Annual Inflation Rate (%) | Core Inflation Rate (%) |

|---|---|---|---|

| December 2023 | 0.4 | 2.9 | 3.2 |

| November 2023 | 0.3 | 2.7 | 3.3 |

| October 2023 | 0.5 | 3.0 | 3.4 |

What Can You Do?

For families trying to keep budgets balanced, staying informed about these changes is key. Many people might consider adjusting their shopping habits by looking for sales or buying in bulk. Others may want to save a little more, just in case prices rise further.

In conclusion, keeping an eye on the Consumer Price Index (CPI) can help you navigate your spending and plan effectively for the future. The twists and turns of inflation are ongoing, so staying knowledgeable about these changes can be a tool for your financial health.