Canada $300 January Federal Payment for 2025: The Canadian government continues to support its citizens with targeted financial aid programs. In 2025, eligible Canadians can look forward to a $300 federal payment, aimed at assisting low- to moderate-income individuals and families. Understanding the payment dates, eligibility criteria, and the application process is essential to ensure you receive this benefit. This article will break down everything you need to know to make the most of this financial aid.

Canada $300 January Federal Payment for 2025

| Aspect | Details |

|---|---|

| Payment Amount | $300 |

| Eligibility Criteria | Canadian residents, over 18 years old, with low to moderate income, and tax compliance |

| Payment Dates | Throughout 2025; exact dates depend on program |

| Application Process | Apply through My CRA Account with proof of income, age, and residency |

| Official Resources | Visit the Canada Revenue Agency (CRA) for more information |

The $300 federal payment for 2025 is a critical support measure aimed at helping Canadians manage rising living costs. By understanding the eligibility criteria, application process, and payment dates, you can ensure you receive the financial assistance you’re entitled to. Stay informed by regularly checking your My CRA Account and consulting official resources like the Canada Revenue Agency website.

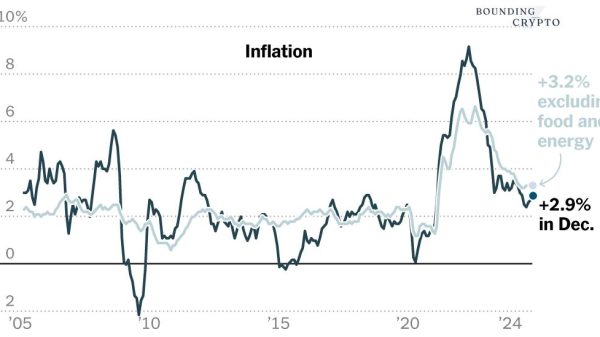

What Is the $300 Federal Payment?

The $300 federal payment is part of Canada’s broader initiative to provide financial assistance to citizens who need it most. This one-time payment is designed to help eligible Canadians manage essential expenses, including housing, groceries, and utilities. By addressing the financial challenges faced by low- to moderate-income households, the government aims to alleviate some of the economic stress caused by inflation and rising living costs.

Purpose of the Payment

- Financial Relief: The payment helps cover basic living expenses.

- Support for Vulnerable Populations: Focused on individuals and families with lower income.

- Economic Stability: Designed to boost household purchasing power and economic security.

Eligibility Criteria for the $300 Federal Payment

To qualify for the federal payment, applicants must meet certain criteria established by the Canada Revenue Agency (CRA). These criteria ensure that the support reaches those who need it most.

General Eligibility Requirements

- Age Requirement: Must be 18 years or older. Exceptions may apply for specific benefit programs.

- Residency: Must be a resident of Canada at the time of application and payment.

- Income Level: Primarily targeted at low- to moderate-income individuals and families.

- Tax Compliance: Applicants must have filed their taxes for the previous year.

- Special Groups: Parents or guardians of children under 18 years and individuals receiving disability benefits may also qualify.

Required Documentation

Applicants are required to provide the following:

- Proof of Income: Recent tax filings or income statements.

- Proof of Residency: Utility bills, lease agreements, or government-issued ID.

- Proof of Age: Birth certificate, passport, or driver’s license.

Payment Dates and Related Benefits

The Canadian government will distribute the $300 federal payment on specific dates throughout 2025. The exact payment schedule depends on the benefit program under which you qualify.

Key Payment Dates for 2025

| Benefit Program | Payment Dates |

| GST/HST Credit | Quarterly: January, April, July, October |

| Canada Child Benefit (CCB) | Monthly, typically around the 20th of each month |

| Climate Action Incentive Payment (CAIP) | Quarterly: January, April, July, October |

| Advanced Canada Workers Benefit | Biannually: July and December |

Note: Exact dates for the $300 payment may vary by program. Check the CRA benefits calendar for the most up-to-date information.

How to Apply for the $300 Federal Payment

Receiving your federal payment is a straightforward process if you follow the correct steps. Here’s a detailed guide:

Step 1: Create a My CRA Account

- Why?: Your My CRA Account is the central hub for managing all your benefits and tax-related information.

- How?: Visit the CRA website to register. You’ll need your Social Insurance Number (SIN), postal code, and recent tax information.

Step 2: Submit Required Documentation

- What You Need: Upload proof of income, residency, and age.

- Where to Submit: Use the My CRA Account for secure document submission.

Step 3: Confirm Your Eligibility

- Log in to your My CRA Account regularly to check your application status and eligibility updates.

Step 4: Set Up Direct Deposit

- Why?: Direct deposit ensures you receive your payment quickly and securely.

- How?: Update your banking information in your My CRA Account.

Benefits Beyond the $300 Payment

The $300 federal payment is one of many financial support programs available to Canadians. Here are a few other key benefits to consider:

1. GST/HST Credit

This quarterly payment helps offset the cost of goods and services taxes for low-income households.

2. Canada Child Benefit (CCB)

A monthly benefit for families with children under 18, aimed at reducing child care costs.

3. Climate Action Incentive Payment (CAIP)

Designed to help Canadians offset the cost of carbon pricing, this quarterly payment is available to residents in eligible provinces.

4. Advanced Canada Workers Benefit

A refundable tax credit for low-income workers to supplement their earnings.

Canada $430 Rent Relief Payment in January 2025? Check Eligibility, Payment Date

Canada $628 Grocery Rebate in 2025 – Is it true? Check Eligibility, Rebate date and Status

Canada $1850 OAS Monthly Boost – Only these people will get this OAS Pension, Check Payment Date

Frequently Asked Questions (FAQs)

1. Who is eligible for the $300 federal payment?

Eligible individuals include Canadian residents aged 18 or older, with low to moderate income, who have filed their taxes for the previous year. Special provisions may apply for parents, guardians, and individuals with disabilities.

2. Do I need to apply for the payment?

In most cases, if you meet the eligibility criteria and have a My CRA Account, the payment will be processed automatically. However, some individuals may need to provide additional documentation.

3. When will I receive my payment?

Payment dates vary depending on the program under which you qualify. Check the CRA benefits calendar for specific dates.

4. Is the $300 payment taxable?

Yes, the $300 payment is considered taxable income and must be reported on your income tax return.

5. What should I do if I don’t receive my payment?

Contact the CRA directly through their helpline or your My CRA Account for assistance.