The application of the third stimulus check would help families who are affected by the Covid-19 pandemic.

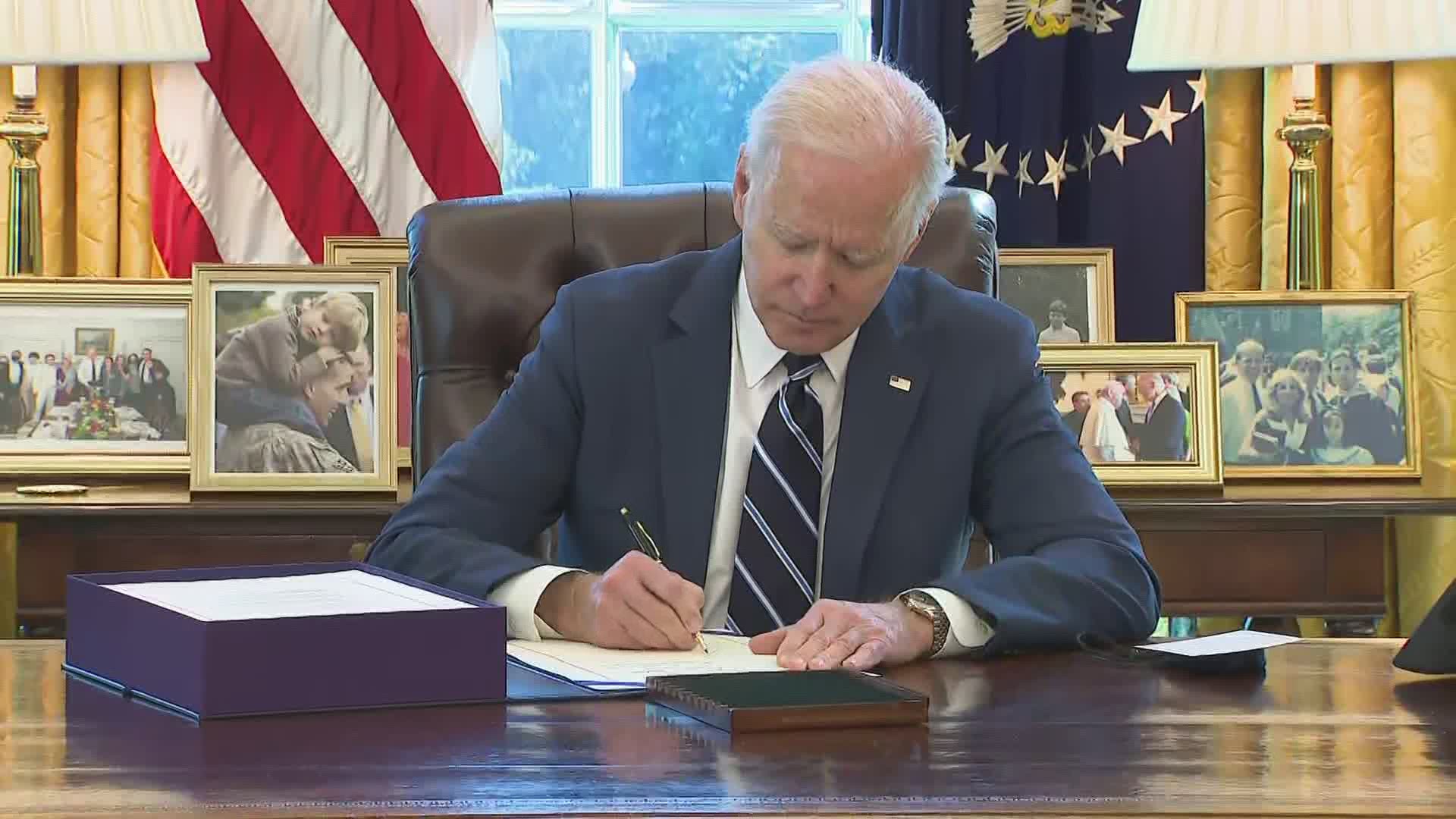

Third stimulus checks for the US Citizens. (Photo: Debt. Org)

The Recovery Rebate Credit is a tax credit designed to provide individuals with additional funds if they did not receive the full amount of the Economic Impact Payments (stimulus checks).

The Application for Recovery Rebate Credit and claiming the Third Stimulus Check can provide much-needed financial relief during these challenging times. It was introduced by the government to support individuals and families affected by the Covid-19 Pandemic.

How to apply for the third stimulus check?

To apply Recovery Rebate Credit you will need to gather the necessary documentation, such as your previous stimulus payment records and income information.

For the completion of the tax return, you will use Form 1040 or 1040-SR and include the appropriate amounts for the Recovery Rebate Credit.

If you are eligible, the credit will either increase your tax refund or reduce the amount of taxes owed.

READ ALSO: Minnesota Tax Rebate Check: How to Update Info To Get Rebate

It’s essential to IRS (Internal Revenue Service) review the guidelines and instructions to ensure you complete the necessary forms accurately.

Keep in mind that the deadlines for filing your tax return and claiming the Recovery Rebate Credit.

READ ALSO: IMF Inflation Forecast: What Inflation Means for Stock Market Investors