Back-to-School Sales Tax Holidays: Saving Big on Essential Supplies in Multiple States!

As the new school year approaches, families in several states are benefitting from sales tax holidays, a temporary waiver of sales tax on essential school supplies, with varying limits and dates to alleviate financial burdens.

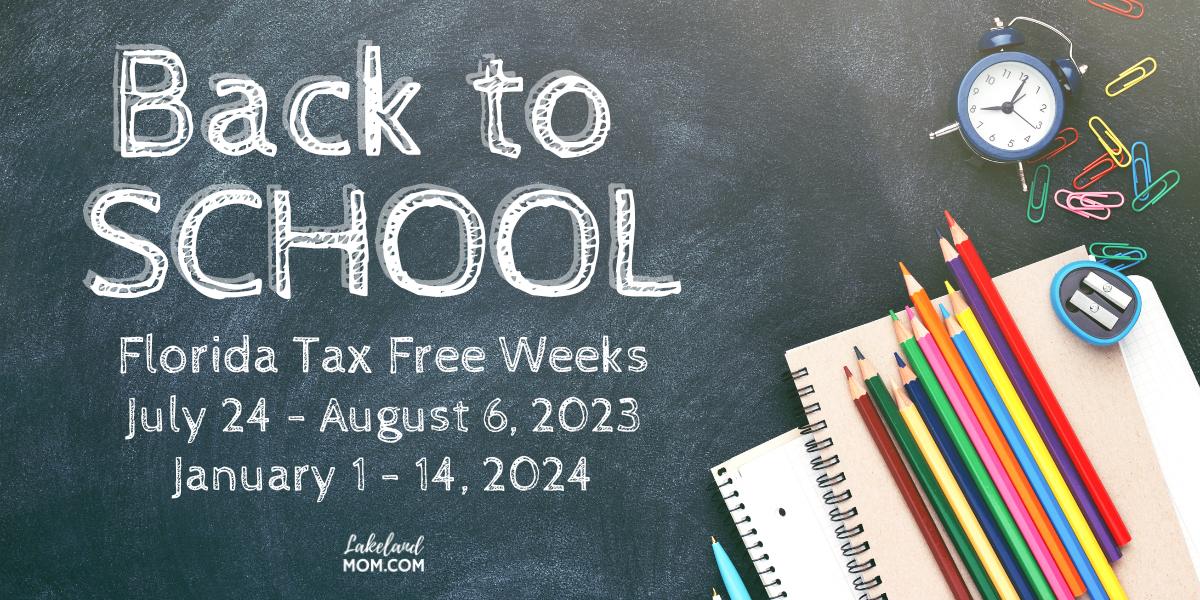

Florida, among other several states, has already imposed a sales tax holiday last July 24, 2023 (PHOTO: Lakeland Mom)

READ ALSO: SWITCH TO T-MOBILE HOME INTERNET SERVICE: ENJOY INCENTIVES AND SAVINGS!

Back-to-School Budget Relief: Sales Tax Holidays Sweep Across States, Easing Costs for Families and Students

As the new school year approaches, families across the country may find themselves concerned about the expenses associated with essential school supplies such as books, binders, pens, and pencils. Fortunately, several states that typically impose a state tax are implementing “sales tax holidays” to alleviate this burden. A sales tax holiday is a specific timeframe during which the state temporarily waives the sales tax on certain items, typically up to a specified spending limit.

According to GMA, the participating states have different rules and limits for tax-free spending. For example, Florida and Tennessee are exempting computer purchases up to $1,500 from sales tax, while Arkansas has no spending limit for tax-free school supplies. New Jersey, on the other hand, has no sales tax on school and art supplies and offers a maximum tax-free computer purchase limit of $3,000.

Nationwide Tax-Free Shopping: Your Guide to Sales Tax Holidays Across States and Key Dates for Back-to-School Savings

The sales tax holidays have already begun in some states. Alabama’s holiday occurred between July 21 and July 23, while Florida’s started on July 24, followed by Mississippi and Tennessee on July 28. Several other states, including Iowa, Ohio, Oklahoma, Missouri, Arkansas, West Virginia, South Carolina, New Mexico, Texas, Massachusetts, Maryland, Connecticut, and New Jersey, will also have their sales tax holidays on various dates in August and early September. This was reported on ABC News.

It is essential to note that not all states have implemented sales tax holidays, and even during these periods, some cities and counties may still apply local taxes to purchases. Therefore, shoppers should be aware of their specific location’s regulations to make the most of the tax-saving opportunities during the sales tax holiday periods.

READ ALSO: UP TO $1,400 IN E-BIKE REBATES: DENVER’S POPULAR PROGRAM OPENS SOON!