$1,620–$2,700 SSDI Monthly Payments Confirmed for 2025: Millions of Americans who rely on Social Security Disability Insurance (SSDI) could see their monthly payments increase to between $1,620 and $2,700 in 2025. This potential boost is part of annual cost-of-living adjustments (COLA) designed to help beneficiaries keep up with inflation and rising living costs. In this article, we’ll break down what these new payment amounts mean, who qualifies, and how to determine your eligibility.

$1,620–$2,700 SSDI Monthly Payments Confirmed for 2025

| Aspect | Details |

|---|---|

| Payment Range | $1,620 to $2,700 per month, depending on work history and earnings. |

| Eligibility Criteria | U.S. citizens with qualifying disabilities who meet SSDI work credit requirements. |

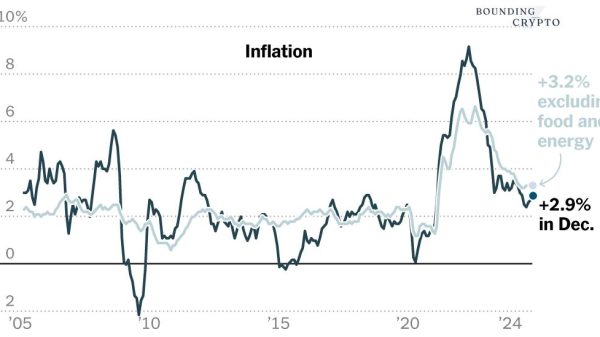

| COLA Increase | Reflects adjustments based on the Consumer Price Index (CPI). |

| Payment Start Date | January 2025. |

| Official Resource | Social Security Administration (SSA). |

The $1,620 to $2,700 SSDI monthly payments in 2025 reflect the government’s commitment to supporting individuals with disabilities. By understanding the eligibility criteria, filing accurate applications, and staying informed about payment schedules, you can maximize your benefits. For more information and updates, visit the SSA website or consult a qualified disability advocate.

What is SSDI, and How Does It Work?

Social Security Disability Insurance (SSDI) provides financial support to individuals who cannot work due to a severe disability. SSDI is funded through payroll taxes and is only available to individuals who have earned sufficient work credits during their employment.

The payment amounts are determined by:

- Lifetime earnings: Your average indexed monthly earnings (AIME) play a significant role.

- Disability onset age: The earlier you qualify, the longer your benefits period.

Why Are SSDI Payments Increasing in 2025?

Each year, SSDI payments are adjusted based on the Cost-of-Living Adjustment (COLA). The COLA is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This ensures that benefits keep pace with inflation.

In 2025, SSDI payments are expected to rise significantly due to sustained inflation and economic factors affecting the cost of goods and services.

Who Is Eligible for SSDI Payments?

To qualify for SSDI, you must meet specific criteria:

1. Disability Requirements

Your disability must:

- Be severe enough to prevent you from engaging in substantial gainful activity (SGA).

- Be listed in the SSA’s Blue Book of qualifying conditions or be deemed medically equivalent.

- Have lasted or be expected to last for at least 12 months or result in death.

2. Work Credit Requirements

SSDI eligibility depends on the number of work credits you’ve earned. Typically:

- 40 work credits are needed, 20 of which must have been earned in the last 10 years.

- Younger individuals may qualify with fewer credits.

3. Citizenship and Residency

- You must be a U.S. citizen or meet specific residency and immigration criteria.

How to Check Your SSDI Payment Eligibility

Step 1: Review Your Earnings Record

Log in to your account on the SSA website to view your earnings record and estimated SSDI benefits.

Step 2: Confirm Work Credits

Ensure you have enough work credits for eligibility. Younger workers with fewer years in the workforce may have adjusted requirements.

Step 3: Medical Documentation

Gather all medical records, doctor’s notes, and diagnostic tests to support your claim of disability.

Step 4: File an Application

If you believe you qualify, file an application through the SSA’s online portal or visit your local Social Security office.

How Payments Are Calculated

SSDI payments are calculated based on your lifetime earnings and the SSA’s formula for Primary Insurance Amount (PIA):

- The SSA takes your highest-earning years to calculate your Average Indexed Monthly Earnings (AIME).

- The PIA is determined using a formula that applies percentages to portions of your AIME.

- The final amount is adjusted for COLA annually.

In 2025, beneficiaries can expect payments ranging from $1,620 to $2,700 per month, depending on their earnings record.

When Will SSDI Payments Be Issued?

SSDI payments for 2025 will start in January and follow the established SSA payment schedule:

| Birth Date | Payment Date |

| 1st-10th | Second Wednesday of each month. |

| 11th-20th | Third Wednesday of each month. |

| 21st-31st | Fourth Wednesday of each month. |

Beneficiaries can check their payment date using their My Social Security account.

What to Do If Your Payment Is Delayed

If you haven’t received your payment on the scheduled date:

- Check Your Bank Account: Confirm whether the payment has been deposited.

- Verify Payment Status: Log in to your My Social Security account for updates.

- Contact the SSA: Call the SSA’s customer service at 1-800-772-1213 or visit your local office.

- Report Issues Promptly: Ensure any address or banking changes are updated with the SSA.

Tips to Maximize Your SSDI Benefits

1. Keep Records Updated

Ensure your medical records and earnings history are accurate and up-to-date with the SSA.

2. Appeal Denials

If your initial application is denied, don’t lose hope. File an appeal and provide additional documentation.

3. Consult a Disability Advocate

A professional advocate or attorney can guide you through the application process and improve your chances of approval.

4. Monitor COLA Announcements

Stay informed about annual COLA changes to understand how they impact your benefits.

5. Utilize Other Support Programs

Explore additional benefits like Medicare or Supplemental Security Income (SSI) if you qualify.

$600+$750 Stimulus Checks In January 2025: Who are eligible to get it? Check Payment Date

$2,000 Stimulus Checks Coming for Seniors on SSI, SSDI, VA Benefits: Stimulus Check Status

Increase in Social Security checks by $1,033 per month – Confirmed by Social Security

Frequently Asked Questions (FAQs)

1. Will all SSDI recipients see the maximum increase?

No, the actual increase depends on your lifetime earnings and eligibility for COLA adjustments.

2. Can I work while receiving SSDI?

Yes, but there are limits. You must not exceed the Substantial Gainful Activity (SGA) threshold, which is $1,470 per month in 2024 (adjusted annually).

3. How does COLA impact SSDI?

COLA increases are applied annually to adjust SSDI benefits based on inflation, ensuring recipients maintain purchasing power.

4. What if I don’t meet work credit requirements?

If you don’t qualify for SSDI, you may be eligible for Supplemental Security Income (SSI), which is based on financial need rather than work history.

5. How do I appeal an SSDI denial?

File an appeal within 60 days of receiving your denial notice. You can do this online or at your local SSA office.