Millions of Americans who rely on Supplemental Security Income (SSI) and Social Security benefits are set to receive a much-needed increase in their payments in 2025. The Social Security Administration (SSA) has announced a 2.5% cost-of-living adjustment (COLA) for 2025, impacting monthly payments for millions of beneficiaries. Whether you’re receiving $484, $967, or $1,450, this boost ensures recipients keep pace with rising living costs.

But how does this adjustment affect your monthly payments? Let’s break down the details, including eligibility, payment schedules, and how the increase works.

$484, $967, or $1,450 SSI Payments in 2025

| Aspect | Details |

|---|---|

| Payment Amounts | $484 (individuals with reduced benefits), $967 (average benefits), $1,450 (couples and higher tiers) |

| COLA Increase | 2.5% boost to SSI and Social Security payments for 2025 |

| Eligibility | All SSI and Social Security beneficiaries, including retirees, disabled individuals, and survivors |

| Payment Schedule | Monthly payments start in January 2025 |

| Official Resources | Social Security Administration Cost-of-Living Adjustment FAQs |

The 2.5% COLA increase for 2025 is a welcome adjustment for SSI and Social Security beneficiaries, helping millions of Americans manage rising living costs. Whether you’re receiving $484, $967, or $1,450, this boost ensures your benefits maintain their value in an ever-changing economy. Stay informed, update your details with the SSA, and plan for the new payment schedule.

What Is the 2.5% COLA and Why Is It Important?

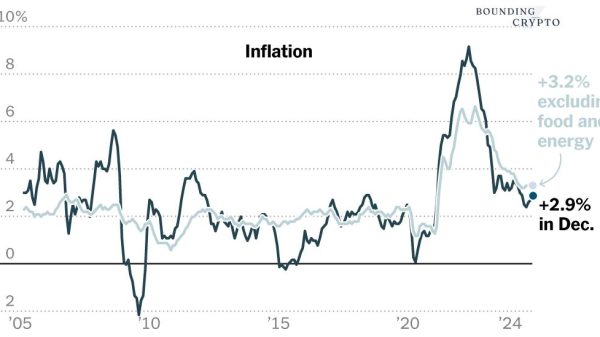

The Cost-of-Living Adjustment (COLA) is an annual increase in Social Security and SSI benefits, designed to help recipients keep up with inflation. COLA is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures changes in the cost of goods and services.

In 2025, the 2.5% COLA means recipients will see their payments increase automatically, providing extra financial support to cover rising costs for essentials like groceries, housing, and healthcare.

Why Is COLA Necessary?

According to the Bureau of Labor Statistics (BLS), inflation has been steadily increasing, with essentials like food and medical care seeing significant price hikes. Without COLA, Social Security and SSI beneficiaries would lose purchasing power over time.

SSI Payment Amounts for 2025

The new COLA adjustment will impact beneficiaries differently based on their current payment levels. Here’s how the increase translates to actual dollar amounts:

1. Individual Beneficiaries

- Current Amount: $484 (minimum payment for individuals with reduced benefits).

- New Amount: $496 (with 2.5% increase).

2. Average SSI Recipients

- Current Amount: $967 (typical payment for many SSI beneficiaries).

- New Amount: $991.

3. Couples and Higher Tiers

- Current Amount: $1,450 (maximum payment for couples or higher eligibility levels).

- New Amount: $1,486.

State Supplements

Some states offer additional SSI payments. For example:

- California: Adds up to $160 monthly for eligible residents.

- New York: Provides state supplements of up to $87.

Check with your state’s SSA office to determine if you qualify for additional benefits.

2025 Payment Schedule

The SSA has outlined the following schedule for SSI and Social Security payments in 2025:

| Month | Payment Dates | Notes |

| January | January 2 (adjusted for holiday) | First payment with COLA increase. |

| February | February 1 | Regular payment. |

| March | March 1 and March 31 | Double payment month for SSI. |

| April | April 1 | Regular payment. |

| May | May 1 | Regular payment. |

| June | June 3 | Adjusted for weekend. |

| July | July 1 | Regular payment. |

| August | August 1 | Regular payment. |

| September | September 2 and September 30 | Double payment month for SSI. |

| October | October 1 | Regular payment. |

| November | November 1 | Regular payment. |

| December | December 3 | Adjusted for weekend. |

For personalized payment schedules, visit the SSA Payment Schedule.

Who Is Eligible for the 2.5% COLA Increase?

The COLA adjustment applies to all SSI and Social Security beneficiaries, including:

1. Retirees

Individuals receiving retirement benefits will automatically see the 2.5% increase reflected in their payments.

2. Disabled Individuals

SSI and Social Security Disability Insurance (SSDI) recipients are eligible for the adjustment.

3. Survivors

Widows, widowers, and children receiving survivor benefits will also benefit from the increase.

4. Low-Income Individuals

People receiving minimum SSI payments due to income or resource limits will still see a proportional increase.

$1600 Stimulus Checks Coming in 2025: Is it Real? Fact Check & Eligibility

$5000 Stimulus Payment Eligibility & Payment Date: Start Saving More Money for your Child

How to Ensure You Receive Your Adjusted Payment

To avoid delays or errors, follow these steps:

1. Update Your Information

- Direct Deposit: Ensure your bank account details are correct with the SSA.

- Mailing Address: Notify the SSA of any changes to your address.

2. Use the “My Social Security” Portal

- Log in to your online SSA account (My Social Security) to verify payment amounts and schedules.

3. Report Changes in Income or Resources

- For SSI recipients, changes in income, living arrangements, or resources may affect payment amounts. Report these changes promptly to the SSA.

4. Beware of Scams

- The SSA will never call or email to ask for personal information. Report suspicious activity to the Office of the Inspector General.

Frequently Asked Questions (FAQs)

1. What is the purpose of the COLA increase?

The COLA adjustment ensures that Social Security and SSI benefits keep pace with inflation, maintaining recipients’ purchasing power.

2. When will I receive my increased payment?

The first payment reflecting the 2.5% COLA will arrive in January 2025.

3. How is COLA calculated?

COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures changes in the cost of living.

4. Do I need to apply for the COLA increase?

No, the increase is automatic for all eligible beneficiaries.

5. Are SSI benefits taxable?

No, SSI benefits are not subject to federal taxes. However, Social Security benefits may be taxable depending on your total income.