$1300 Cash Relief Payment from Commonwealth Bank: The Commonwealth Bank of Australia (CBA) has announced a $1300 cash relief initiative to support account holders facing financial stress. This move is part of a broader effort to provide assistance during challenging economic times, such as rising inflation and increasing living costs. But what does this mean for you, and who qualifies for this benefit?

This article explores the details of the $1300 cash relief, including eligibility criteria, how to apply, and when you can expect the payment.

$1300 Cash Relief Payment from Commonwealth Bank

| Aspect | Details |

|---|---|

| Relief Amount | Up to $1300 per eligible account holder |

| Eligibility Criteria | Account holders with demonstrated financial hardship; specific accounts such as transaction, savings, or credit card accounts are eligible |

| Application Process | Some payments are automatic; others require submission of a hardship request through CBA’s financial assistance team |

| Disbursement Timeline | Payments expected to roll out starting February 2025 |

| Official Resources | Commonwealth Bank Financial Assistance Australian Government Financial Support |

The $1300 cash relief initiative by the Commonwealth Bank offers timely support to Australians facing financial difficulties. Whether you’re eligible for automatic payments or need to submit a hardship request, this program is designed to ease the burden of rising costs. Ensure your account information is current, and don’t hesitate to reach out to CBA for assistance.

Why Is the Commonwealth Bank Offering $1300 Cash Relief?

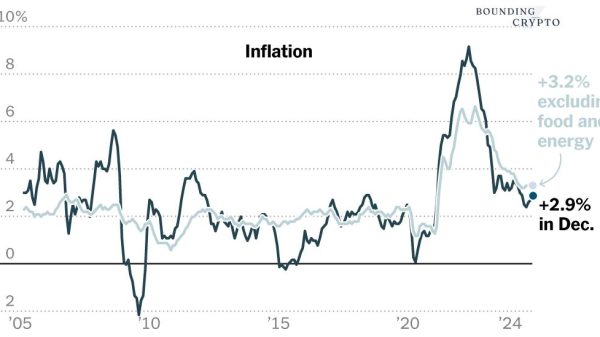

Economic challenges such as rising inflation, increased interest rates, and the high cost of living have put immense financial pressure on Australian households. The Commonwealth Bank recognizes this and aims to provide targeted relief to its customers to help them manage essential expenses such as housing, utilities, and groceries.

Addressing Financial Hardship

This initiative is part of CBA’s broader commitment to social responsibility. The cash relief program is designed to assist those who are most in need, especially account holders who are experiencing genuine financial hardship due to unforeseen circumstances like job loss, illness, or other economic setbacks.

Who Is Eligible for the $1300 Cash Relief?

Not all Commonwealth Bank account holders will automatically receive this payment. Eligibility depends on several factors, including account type and financial situation. Here’s what you need to know:

1. Account Type

The following account holders may be eligible:

- Transaction Accounts: Everyday bank accounts used for daily expenses.

- Savings Accounts: Accounts with funds set aside for short- or long-term savings.

- Credit Card Accounts: Customers with overdue balances or financial difficulties related to credit repayments.

2. Financial Hardship

To qualify for the $1300 relief, account holders must demonstrate financial hardship. This may include:

- Loss of Income: Due to unemployment, reduced work hours, or illness.

- Increased Expenses: Such as unexpected medical bills, childcare costs, or higher rent.

- Debt Management Issues: Difficulty managing multiple loan or credit repayments.

3. Residency Requirement

You must be an Australian resident to qualify for this relief.

How to Apply for the $1300 Cash Relief

The application process depends on your situation and account type. Here’s a step-by-step guide:

1. Check Automatic Eligibility

Some customers will automatically receive the payment based on their account status and financial history. If you’re eligible for automatic disbursement, the funds will be deposited directly into your account.

2. Submit a Hardship Request

For those who do not qualify automatically, you can apply for the relief by:

- Contacting CBA’s Financial Assistance Team: Reach out via phone or the online portal.

- Providing Documentation: Submit proof of financial hardship, such as pay slips, medical bills, or letters of termination.

- Filling Out the Hardship Application: Available on the Commonwealth Bank website.

3. Monitor Your Application

Once your application is submitted, you’ll receive updates via email or SMS. Processing times may vary, but most decisions are made within 10-15 business days.

When Will Payments Be Made?

The Commonwealth Bank plans to start disbursing the $1300 cash relief in February 2025. Payments will be staggered over several weeks to ensure all eligible account holders receive their funds promptly.

- Automatic Payments: Likely to be disbursed in the first week of February.

- Application-Based Payments: Will be processed within 10-15 business days of approval.

To ensure timely payment, make sure your banking details and contact information are up to date with CBA.

Social Security $5108 Payments Coming in 2025 – Are You Eligible? Check Date

Increase in Social Security checks by $1,033 per month – Confirmed by Social Security

How Will the $1300 Relief Benefit Account Holders?

The $1300 cash relief can be a game-changer for families and individuals struggling to make ends meet. Here are some practical ways this payment can help:

1. Cover Essential Expenses

Use the relief funds for necessities like:

- Rent or Mortgage Payments: Ensure housing stability.

- Utility Bills: Avoid disconnections of electricity, water, or gas.

- Groceries: Buy essential food items for your household.

2. Pay Down Debt

Reduce the burden of high-interest debt by applying the funds to:

- Credit Card Balances

- Personal Loans

- Overdue Utility or Medical Bills

3. Emergency Savings

Set aside the relief payment in a savings account to build an emergency fund for future unexpected expenses.

Frequently Asked Questions (FAQs)

1. Do I need to apply for the $1300 cash relief?

It depends. Some account holders will receive automatic payments, while others will need to apply and provide proof of financial hardship.

2. How do I know if I qualify?

Check your eligibility by contacting CBA’s Financial Assistance Team or logging into your online banking account for notifications.

3. What documents are required for the application?

Documents such as pay slips, termination letters, medical bills, or bank statements may be required to demonstrate financial hardship.

4. Can I receive the payment if I’m not a CBA account holder?

No, this relief program is exclusive to Commonwealth Bank account holders.

5. Are there any fees or taxes on the relief payment?

No, the $1300 payment is tax-free and does not involve any additional fees.