The reality is that 66% of Black Americans support President Biden’s performance, as he has addressed significant concerns and priorities for the Black community, leading to progress and empowerment. Conversely, 34% have different views on the impact of his policies; one of these is the Bureau’s Late Fee Rule.

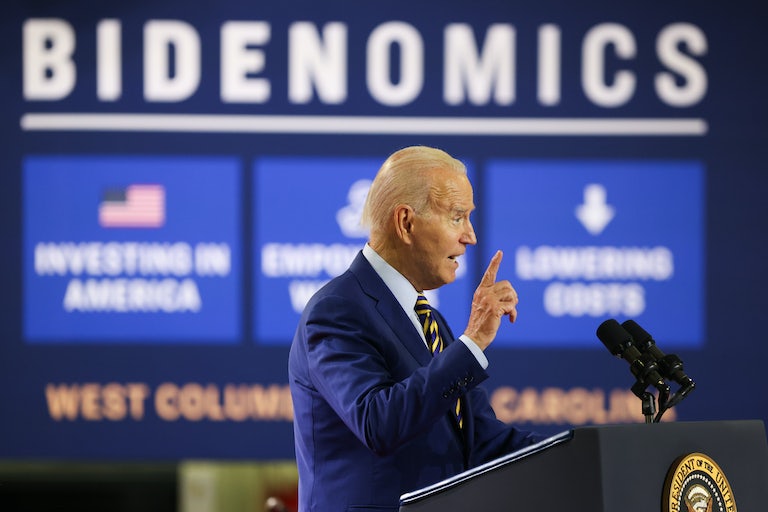

66% of Black Americans support President Biden’s performance. (Photo: The New Republic)

The Junk Fee Prevention Act, which was just introduced, is also a breath of new air

On his first day in office, President Biden fulfilled his promises by signing an executive order funding historically Black colleges and addressing other priority issues such as student loan forgiveness, marijuana offenses, and diverse judicial nominations. The Junk Fee Prevention Act, recently introduced, aims to make hidden fees transparent. However, it is crucial to separate this positive initiative from the Consumer Financial Protection Bureau’s proposed rule on capping credit card late fees. This late fee rule could inadvertently harm communities of color and create more problems than solutions.

While only a small percentage of Americans currently have delinquent credit card balances, the consequences of the proposed late fee rule would affect everyone. Rejecting such a late fee rule is essential. Financial institutions have already indicated their intention to respond by increasing rates, tightening credit lines, and discontinuing free services, potentially leading to higher fees and financial strain. Nearly 40% of credit unions have expressed plans to charge elevated fees on other products to recover losses.

The proposed late fee rule from the Consumer Financial Protection Bureau, as published in the article in The Center Square, risks causing significant harm and is not financially feasible. President Biden must navigate this issue carefully, considering the potential unintended consequences. It is crucial to prioritize economic stability for all communities, particularly communities of color, while avoiding policies that may exacerbate financial burdens.

READ ALSO: Biden Targets “Junk” Insurance, Promising Consumer Savings And Protection

Late Fee Rule Raises Concerns for Black Americans’ Financial Well-being

The late fee rule is problematic, especially for Black Americans who already face difficulties in accessing credit and are more likely to be credit invisible compared to white Americans. Imposing higher fees and reducing banking amenities will only increase vulnerability to predatory lending practices like payday loans, which are still legal in 31 states. Black Americans are disproportionately targeted by predatory lenders, constituting a significant percentage of all storefront payday loans.

Addressing predatory lending, rather than self-inflicted credit card late fees, is crucial to uplift minority communities from financial challenges. As Biden embarks on his presidential campaign, it is important to highlight the progress made for the Black community. This is not the time for the Consumer Financial Protection Bureau (CFPB) to implement a rule that could unintentionally cause more harm than good.

READ ALSO: Lawmakers Return To Capitol Hill For Intense Legislative Push Amidst Rising Stakes