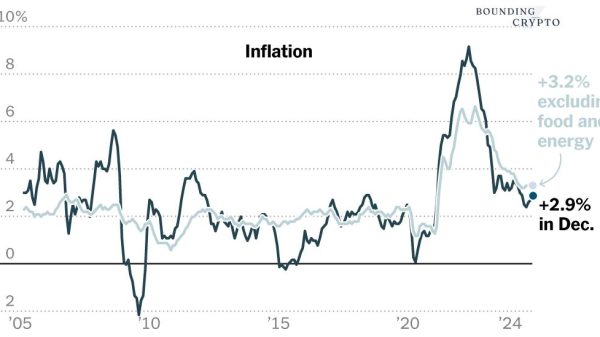

$600+$750 Stimulus Checks In January 2025: Millions of Americans are set to receive $600 and $750 stimulus checks as part of a new federal and state initiative to provide financial relief. With rising inflation, increased living costs, and economic uncertainty, these payments aim to help individuals and families bridge financial gaps. But who qualifies for these payments, and when can you expect them?

In this article, we break down the details of these stimulus checks, including eligibility criteria, payment timelines, and how to ensure you receive your money.

$600+$750 Stimulus Checks In January 2025

| Aspect | Details |

|---|---|

| Payment Amounts | $600 federal stimulus checks; $750 state-level relief payments |

| Eligibility Criteria | Income thresholds for federal checks; state payments vary by residency and financial hardship |

| Disbursement Timeline | Federal payments start in January 2025; state payments vary but are expected to roll out by March 2025 |

| Application Process | Federal payments are automatic for taxpayers; state payments may require an application or proof of hardship |

| Official Resources | IRS Economic Impact Payment Info State Relief Programs |

The $600 federal and $750 state stimulus checks provide much-needed financial relief for Americans navigating economic challenges. By understanding eligibility requirements and ensuring your information is up to date, you can secure your payment and use it wisely to meet essential needs or plan for the future. Don’t miss out on these opportunities—stay informed and take action today.

What Are the $600 and $750 Stimulus Checks?

The $600 federal stimulus checks are part of a broader federal relief package aimed at supporting middle- and low-income families affected by economic pressures. The $750 state-level payments are supplementary relief initiatives launched by individual states to address localized financial challenges.

These payments are one-time disbursements designed to help recipients cover essential expenses like rent, groceries, and utilities during challenging times.

Who Qualifies for These Stimulus Payments?

Eligibility for these payments depends on income levels, residency, and financial circumstances. Let’s break it down by type:

1. Federal $600 Stimulus Checks

To qualify for the $600 federal stimulus payment, you must:

- File Taxes: Your eligibility is based on your 2024 tax return.

- Income Thresholds:

- Single filers: Adjusted Gross Income (AGI) under $75,000 (phases out up to $99,000).

- Married filing jointly: AGI under $150,000 (phases out up to $198,000).

- Head of household: AGI under $112,500 (phases out up to $146,500).

- Citizenship or Residency: You must be a U.S. citizen or resident alien with a valid Social Security number.

- Dependents: Eligible dependents may qualify for an additional $300 per child.

2. State-Level $750 Stimulus Payments

State-specific eligibility varies. Common criteria include:

- Residency: You must reside in the state offering the payment.

- Financial Hardship: Proof of income loss, medical expenses, or other financial challenges may be required.

- Tax Filing: Some states use tax records to determine eligibility.

For detailed state-specific eligibility, visit your state’s relief program page or USA.gov State Benefits.

How to Apply for the Stimulus Payments

Federal $600 Stimulus Checks

The federal payments are automatic for most taxpayers. To ensure you receive your payment:

- File Your 2024 Tax Return: Payments are based on the most recent tax return filed with the IRS.

- Update Banking Information: Log in to your IRS account to verify or update direct deposit details.

- Track Your Payment: Use the IRS’s “Get My Payment” tool to check the status of your stimulus check.

State-Level $750 Payments

State payments may require additional steps:

- Check Eligibility: Visit your state’s relief program website.

- Submit an Application: Some states require proof of financial hardship, residency, or other documentation.

- Monitor Notifications: States will provide updates via email or mail once your application is reviewed.

When Will Payments Be Issued?

Federal Payments

The IRS has announced that $600 federal stimulus checks will begin disbursements in January 2025. Payments will follow this timeline:

- Direct Deposits: First to be issued, typically within two weeks of the rollout.

- Paper Checks: Mailed starting in early February 2025.

- Prepaid Debit Cards: Issued to select recipients by mid-February 2025.

State Payments

State timelines vary. Most payments are expected to roll out by March 2025. Check with your state’s relief program for exact dates.

$2000 Economic Relief Payment Coming for these Eligible Americans, Will You Get it? Check Date

Social Security $5108 Payments Coming in 2025 – Are You Eligible? Check Date

New $1924 Monthly Direct Deposit Check From December 2024, Will you get it? Check Here

How to Use Your Stimulus Payment Wisely

Receiving extra cash can be a relief, but using it strategically ensures maximum benefit. Here are some tips:

1. Cover Essentials First

Use your payment to cover urgent needs like:

- Rent or Mortgage Payments: Avoid late fees or potential eviction.

- Utilities: Keep your electricity, water, and heating services running.

- Groceries: Stock up on essential food items.

2. Pay Down Debt

Consider applying your payment to high-interest debts, such as:

- Credit Card Balances

- Personal Loans

3. Build an Emergency Fund

If you’re financially stable, use the payment to create or grow an emergency savings account.

4. Invest in Long-Term Needs

Consider spending the funds on:

- Educational Resources: Books, courses, or certifications to enhance your skills.

- Home Repairs: Address minor issues before they become costly problems.

Frequently Asked Questions (FAQs)

1. Will I receive both the $600 and $750 payments?

Yes, if you qualify for both the federal and state programs, you can receive both payments. Eligibility for each is determined separately.

2. Do I need to apply for the $600 federal payment?

No, federal payments are automatic for eligible taxpayers based on their 2024 tax returns.

3. What happens if I don’t file taxes?

Non-filers may need to submit additional documentation to the IRS or use a simplified filing process. Check the IRS website for updates.

4. Are these payments taxable?

No, both the $600 federal and $750 state stimulus payments are not considered taxable income.

5. How can I track my payment status?

For federal payments, use the IRS’s “Get My Payment” tool. For state payments, visit your state’s relief program website.