In 2025, eligible seniors in Canada can receive a monthly Old Age Security (OAS) payment of $1,790, plus an additional $943 in Guaranteed Income Supplement (GIS) for those who qualify. These benefits are essential for retirees looking to secure their financial future. Understanding the ins and outs of these programs can make a significant difference for Canadians planning their retirement years. Here’s everything you need to know about eligibility, payment dates, and tips for maximizing your benefits.

$1,790 Plus $943 in OAS Benefits Monthly in 2025

| Aspect | Details |

|---|---|

| Monthly OAS Payment | Up to $1,790 per month. |

| Additional GIS Benefits | Up to $943 monthly for eligible low-income seniors. |

| Eligibility Criteria | Canadian citizens or legal residents aged 65 and above. |

| Payment Dates | Payments issued on the last three banking days of each month. |

| Official Resources | Canada.ca OAS, GIS Info. |

The $1,790 OAS benefit with an additional $943 GIS payment provides substantial financial support to eligible Canadian seniors in 2025. Understanding the eligibility criteria, application process, and ways to maximize these benefits can significantly improve your retirement experience. Whether you’re approaching 65 or already retired, these programs are designed to help you maintain financial security. Visit the Canada.ca OAS website today to learn more and start planning your financial future.

What Are OAS and GIS Benefits?

The Old Age Security (OAS) program is Canada’s largest pension plan, designed to provide financial support to seniors aged 65 or older. Unlike the Canada Pension Plan (CPP), OAS does not require prior contributions, making it a vital safety net for retirees. It provides financial security for seniors who may not have significant private savings or workplace pensions.

The Guaranteed Income Supplement (GIS) is an additional monthly benefit provided to low-income seniors who qualify for OAS. Together, these benefits help ensure financial stability for older Canadians, particularly those most vulnerable to economic challenges.

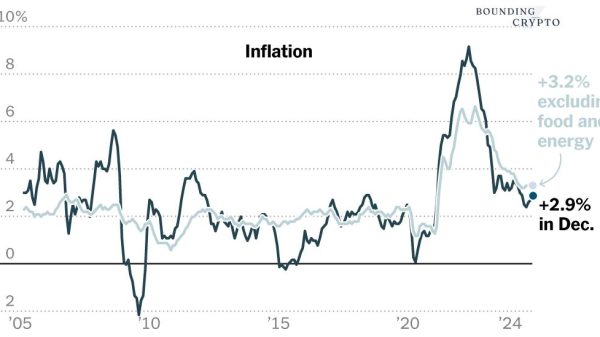

These programs are indexed to inflation, ensuring that payments keep pace with the rising cost of living. They aim to reduce poverty and improve the quality of life for seniors across Canada.

Eligibility Criteria

To qualify for OAS and GIS benefits, applicants must meet specific criteria:

1. Age

- Must be 65 years or older to qualify for OAS.

- GIS eligibility is tied to receiving OAS, so applicants must meet the age requirement for both programs.

2. Residency

- Must be a Canadian citizen or legal resident.

- Must have lived in Canada for at least 10 years after the age of 18 to qualify for partial OAS payments.

- For the full OAS benefit, applicants must have lived in Canada for at least 40 years after turning 18. Partial benefits are prorated for shorter residency periods.

3. Income Thresholds (GIS)

- For GIS eligibility, annual income must fall below specific limits:

- Single individuals: $20,952 or less.

- Couples (both receiving OAS): $27,648 or less.

- Couples (one receiving OAS and the other receiving Allowance): $38,592 or less.

Income includes earnings, pensions, and investments but excludes certain credits, like the first $5,000 of employment income, which is disregarded.

How to Calculate Your Benefits

OAS and GIS payments depend on several factors, including your income, residency, and marital status.

1. OAS Payment Calculation

The maximum OAS benefit for 2025 is $1,790 per month, indexed to inflation. The exact amount you receive may vary based on:

- Years of Residency: Full benefits require 40 years of residency in Canada. Partial benefits are calculated at 1/40th of the full amount for each year of residency.

- Clawback Threshold: If your annual income exceeds $91,000 in 2025, a portion of your OAS benefits will be clawed back at a rate of 15% of the excess income. For high earners, this could significantly reduce the benefit.

2. GIS Payment Calculation

The additional $943 GIS benefit is available to low-income seniors. It is calculated based on:

- Income: GIS decreases by $1 for every $2 of additional income.

- Marital Status: GIS rates differ for single individuals, couples where both partners receive OAS, and couples where one partner is not eligible for OAS.

Payment Dates for 2025

OAS and GIS payments are issued on the last three banking days of each month. Mark these dates on your calendar to ensure timely financial planning:

- January: January 29, 30, 31

- February: February 26, 27, 28

- March: March 28, 29, 31

- April: April 28, 29, 30

- May: May 29, 30, 31

- June: June 27, 28, 30

- July: July 30, 31, August 1

- August: August 28, 29, September 1

- September: September 27, 30

- October: October 29, 30, 31

- November: November 28, 29, December 1

- December: December 30, 31, January 2 (2026)

How to Apply for OAS and GIS Benefits

Step 1: Determine Eligibility

Use the OAS Eligibility Tool to confirm your qualifications. The tool walks you through questions about residency and income to determine if you meet the requirements.

Step 2: Gather Necessary Documents

Prepare the following:

- Proof of birth (birth certificate or passport).

- Social Insurance Number (SIN).

- Proof of residence in Canada.

- Financial statements showing annual income and sources.

Step 3: Submit Your Application

- Online: Apply through the My Service Canada Account.

- Mail: Download the application form from the OAS website and send it to your regional Service Canada office.

- In-Person: Visit a local Service Canada office for assistance.

Step 4: Track Your Application

Log into your My Service Canada Account to monitor your application status and receive updates. If additional documents are required, you will be notified promptly.

Maximizing Your OAS and GIS Benefits

Here are some tips to ensure you get the most out of your benefits:

1. Delay OAS to Increase Payments

For every month you delay receiving OAS beyond age 65, your payment increases by 0.6%. Delaying up to age 70 can boost your monthly benefit by 36%, which can be especially valuable for those in good health and with other income sources.

2. Minimize Taxable Income

Reducing taxable income through strategies like income splitting, contributing to a Tax-Free Savings Account (TFSA), or deferring RRSP withdrawals can help avoid OAS clawbacks. Discuss with a financial planner to explore personalized options.

3. Combine GIS with Other Benefits

Eligible GIS recipients may also qualify for additional programs, such as:

- Provincial Benefits: Each province offers unique programs for seniors, including energy subsidies, property tax relief, and public transit discounts.

- Housing Assistance: Subsidies for rent or property taxes to reduce housing costs.

- Health Benefits: Coverage for medications, dental care, vision, and mobility aids.

- Allowance for Survivors: Additional benefits for low-income widowed seniors.

Canada $1660 Extra CPP Payments by CRA In January 2025 – Is it really Coming? Check Here

Canada $430 Rent Relief Payment in January 2025? Check Eligibility, Payment Date

Canada Workers can claim Up to $566 in January 2025 – Check Process to get it? Payment Date

Canada CRA New $680 Payment In January 2025 – How to Claim it? Check Payment Date

FAQs: Frequently Asked Questions

1. Can I receive both OAS and CPP?

Yes. OAS is separate from CPP, and you can receive both if you meet the eligibility criteria.

2. Are OAS and GIS payments taxable?

- OAS: Taxable.

- GIS: Non-taxable.

3. What happens if I live outside Canada?

You can still receive OAS if you meet residency requirements, but GIS is only available to residents living in Canada.

4. How often are OAS amounts adjusted?

OAS payments are adjusted quarterly to reflect changes in the Consumer Price Index (CPI), ensuring they keep pace with inflation.

5. Can my spouse’s income affect my GIS?

Yes, GIS payments are calculated based on combined household income for couples. Lower combined income results in higher GIS benefits.

6. What should I do if I miss applying for OAS at 65?

You can apply retroactively for up to 12 months of payments. Delaying longer forfeits those months of benefits.